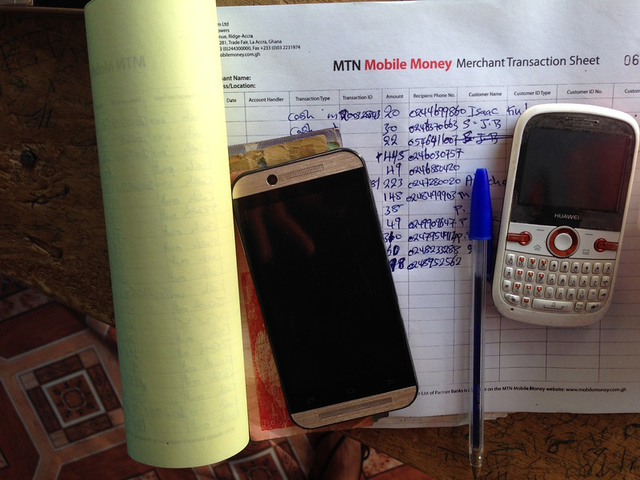

Mobile money is a digital financial service that allows individuals to use their mobile phones to store, send, and receive money. It can play an important role in improving international development programs in Low and Middle-Income Countries (LMICs).

Six Mobile Money Benefits in Development

- Financial Inclusion: Mobile money can help to increase financial inclusion by providing access to financial services for people who are excluded from the traditional banking system. This can help to reduce poverty and improve the standard of living for people in LMICs.

- Improved access to finance: Mobile money can provide a convenient and accessible way for people to store, send, and receive money, even in remote or underserved areas. This can help to improve access to finance for those who need it most, and can increase economic opportunity and growth.

- Increased efficiency: Mobile money can increase the efficiency of financial transactions by reducing the time and cost associated with traditional banking systems. This can make it easier for international development programs to send funds to the countries and organizations that need them.

- Improved data management: Mobile money can provide valuable data on financial transactions and behavior, which can be used to inform decision-making and improve development programs.

- Enhanced security: Mobile money can provide a secure way of storing and transferring funds, reducing the risk of fraud and corruption in the development sector.

- Increased transparency: Mobile money can provide a transparent way of tracking the flow of funds, increasing accountability and reducing the risk of fraud and corruption.

Mobile money can play a significant role in improving international development programs in LMICs. By increasing financial inclusion, improving access to finance, and enhancing efficiency and security, mobile money can help to reduce poverty, promote economic growth, and create a more equitable society.

Apply for $15,000 to Test Mobile Money Payment Systems

Does your organization uses physical cash in operations or programming to implement a development project in Afghanistan, Bangladesh, Haiti, Indonesia, Malawi,...

How Mobile Money Improves Development Outcomes for the Unbanked

At the recent London Technology Salon, we debated “How Mobile Money Can Improve Development Outcomes for the Unbanked?” with 30 thought leaders in...

Surprise! Guess Which Country is 2nd for Mobile Money Globally?

We all know that M-PESA in Kenya dominates the mobile money conversation in Africa, where mobile banking has expanded to 16% of the market. So its easy to assume...

The 4 Most Exciting Developments Right Now in the African Tech Industry

Recently, the always charismatic Teddy Ruge was interviewed by The Stream about the African technology industry. While you can watch the full interview here, there...

Careful in your love of M-PESA and mobile payments to solve every development problem

Do you sometimes feel that every international development organization is in love with mobile money today? That transferring currency equivalents via mobile phones...

The Bi-Weekly ICT4D Retrospective: Important Links for April 25 – May 8, 2012

Nokia in Brazil: You might not know that Nokia’s biggest single social project in the world is in the city of Manaus in the Brazilian Amazon, where Nokia...

Mobile Money is Better than Cash at the Bottom of the Pyramid

Open your wallet right now. Most likely, you have a debit card, a credit card, a health insurance card, and access to the massive financial infrastructure that...

USAID Lessons Learned in Using Mobile Money to Enhance Agriculture Development

Where agriculture development projects find access to financial services a key constraint to success, m-money and m-banking services are potentially important tools...

Mobile Money’s Innovation and Impact Isn’t Targeted at Women… Yet

According to Women & Mobile: A Global Opportunity (PDF), authored by Vital Wave Consulting and sponsored by the GSMA Development Fund and the Cherie Blair Foundation...