Mobile money is a digital financial service that allows individuals to use their mobile phones to store, send, and receive money. It can play an important role in improving international development programs in Low and Middle-Income Countries (LMICs).

Six Mobile Money Benefits in Development

- Financial Inclusion: Mobile money can help to increase financial inclusion by providing access to financial services for people who are excluded from the traditional banking system. This can help to reduce poverty and improve the standard of living for people in LMICs.

- Improved access to finance: Mobile money can provide a convenient and accessible way for people to store, send, and receive money, even in remote or underserved areas. This can help to improve access to finance for those who need it most, and can increase economic opportunity and growth.

- Increased efficiency: Mobile money can increase the efficiency of financial transactions by reducing the time and cost associated with traditional banking systems. This can make it easier for international development programs to send funds to the countries and organizations that need them.

- Improved data management: Mobile money can provide valuable data on financial transactions and behavior, which can be used to inform decision-making and improve development programs.

- Enhanced security: Mobile money can provide a secure way of storing and transferring funds, reducing the risk of fraud and corruption in the development sector.

- Increased transparency: Mobile money can provide a transparent way of tracking the flow of funds, increasing accountability and reducing the risk of fraud and corruption.

Mobile money can play a significant role in improving international development programs in LMICs. By increasing financial inclusion, improving access to finance, and enhancing efficiency and security, mobile money can help to reduce poverty, promote economic growth, and create a more equitable society.

Do Farmers Really Want to be Paid in Mobile Money?

Do farmers really want to be paid in mobile money? To answer this question, I’ll ask you to first entertain a brief thought experiment.

Imagine that your...

5 Barriers to Mobile Financial Services in Bangladesh

Since the launch of Mobile Financial Services in Bangladesh in 2011, significant growth has been observed across

all metrics, from account use to transaction...

The Massive Myanmar Opportunity for Digital Financial Services

Myanmar is experiencing one of the world’s fastest adoption of mobile phones. Three years ago, less than 10% of the population had access to ma mobile phone....

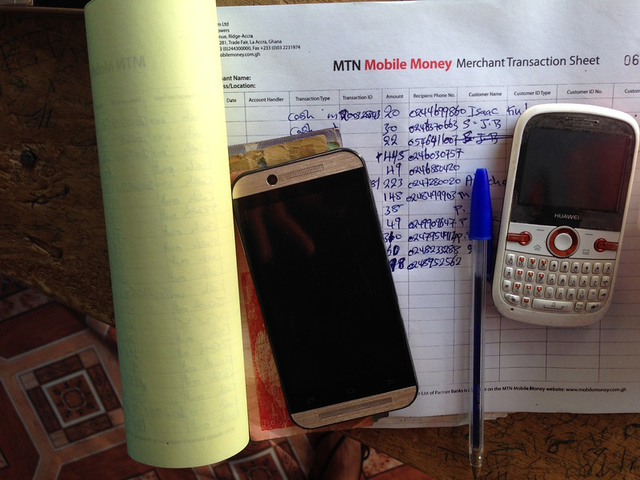

Reducing Risk and Increasing Agricultural Loans with Mobile Money in Ghana

Like in many developing countries, agriculture is the mainstay of the Ghanaian economy. 62 percent of Ghanaians are employed in the sector, says Doris Amponsaa...

Now Scientific Fact: Mobile Money Can Lift Women Out of Poverty

For nearly four years, we have been sharing information about the various ways that gender and mobile intertwine in our Gender and Mobile newsletter. In our...

The Potential for Mobile Money to Improve Government Salary Payments in Liberia

Meet Kou, a health worker in rural Nimba County, Liberia. During the Ebola crisis, Kou took action to combat the disease, going door-to-door in her community to...

How Liberia Can Save Over $5 Million with Mobile Money Salary Payments

Liberia is a cash-based economy, and ATMs are few and far in between, restricted mainly to Monrovia hotels frequented by expats. In fact, as of 2014, some 60% of...

Getting Principled on Digital Financial Services for Development

Digital financial services (DFS) have emerged as complex and yet powerful tool for supporting economic development. Technology-enabled financial services comprise...

The Surprising Reality of Mobile Money Around the World

Mobile money has done more to extend the reach of financial services in the last decade than traditional “bricks and mortar” banking has in the last century.

This...

The Rise of Mobile Money Services in Somaliland

In 2009, Somaliland’s biggest mobile network operator, Telesom, launched their mobile payment service “ZAAD”, and today more than 10% of the 3.8 million inhabitants...