Mobile money is a digital financial service that allows individuals to use their mobile phones to store, send, and receive money. It can play an important role in improving international development programs in Low and Middle-Income Countries (LMICs).

Six Mobile Money Benefits in Development

- Financial Inclusion: Mobile money can help to increase financial inclusion by providing access to financial services for people who are excluded from the traditional banking system. This can help to reduce poverty and improve the standard of living for people in LMICs.

- Improved access to finance: Mobile money can provide a convenient and accessible way for people to store, send, and receive money, even in remote or underserved areas. This can help to improve access to finance for those who need it most, and can increase economic opportunity and growth.

- Increased efficiency: Mobile money can increase the efficiency of financial transactions by reducing the time and cost associated with traditional banking systems. This can make it easier for international development programs to send funds to the countries and organizations that need them.

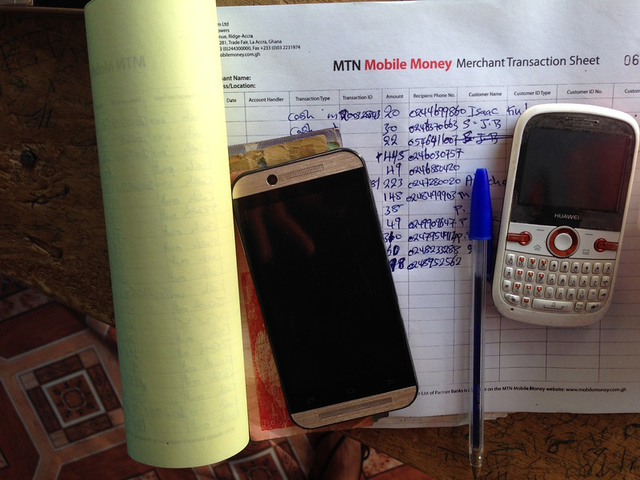

- Improved data management: Mobile money can provide valuable data on financial transactions and behavior, which can be used to inform decision-making and improve development programs.

- Enhanced security: Mobile money can provide a secure way of storing and transferring funds, reducing the risk of fraud and corruption in the development sector.

- Increased transparency: Mobile money can provide a transparent way of tracking the flow of funds, increasing accountability and reducing the risk of fraud and corruption.

Mobile money can play a significant role in improving international development programs in LMICs. By increasing financial inclusion, improving access to finance, and enhancing efficiency and security, mobile money can help to reduce poverty, promote economic growth, and create a more equitable society.

4 Key Enabling Environment Regulations for Digital Financial Services

It can be too easy to get caught up in fun innovative new product launches in digital finance in Kenya, probably the most robust and well-developed digital financial...

4 Case Studies Using Digital Financial Services to Improve Global Health

Digital financial services provide health programs with opportunities to accelerate progress toward global health goals and outcomes. Global health program managers...

What To Do About Uganda’s Social Media and Mobile Money Taxes?

In July 2018, the Ugandan government instituted a 200 shilling, or about $0.05 per day excise duty on Over-the-Top (OTT) social media and instant messaging services...

Apply Now: Digital Financial Services Bootcamp with Gates Foundation

Mobile money and banking payment systems currently operate in silos across most African countries. This locks customers, agents, and banks into rigid systems that...

The Mobile Money Revolution in International Remittances

For those living in poverty or in fragile countries, remittances are a lifeline that far surpasses international aid as a source of income. If properly harnessed,...

We Need a GSMA for Banks to Make Mobile Money Available Everywhere

Mobile money for the poorest, and particularly savings groups, has a long way to go and one of the largest obstacles are traditional banks. Savings groups give...

ICTforAg Case Study: Success with Electronic Vouchers for Farmers in Mozambique

In Mozambique, approximately 4 million farm units are responsible for around 95% of national agricultural production, cultivating an average of 1.5 hectares/family. ...

Wow! Mobile Money Transactions Are Now Larger Than Kenya’s GDP

For years, we’ve heard how the value of M-PESA mobile money transactions are a rising percentage of Kenya’s Gross Domestic Product. In 2010 we reported...

Four Lessons Learned in Piloting Mobile Money for Paying 8 Million Work Days

From 2013 to 2016, I worked on a pilot to pay 8 million of work days in two districts in India through mobile money. The Government of Odisha in India decided to...

The State of Digital Financial Services in Zambia

I have had the privilege of working with UNCDF for almost two years as the Regional Technical Specialist for one of its seminal programmes, MM4P. In Zambia, UNCDF...